Wednesday 30th Mar, 2022

Missed the AGM?

We understand that some of our members may have missed the opportunity to attend our annual AGM, so we’ve gathered these highlights.

We were delighted to reduce our loan rates. Our rates compare very favourably with, for example, credit cards and store cards.

Don't pay more! Check out our new rates here.

We are indebted to John O’Donnell, who volunteered hours of time, his skill and experience to support the board’s review of our loan products.

Despite the pandemic, during 2020-21, we continued to increase adult membership: up 9%, to 1,954 active members at financial year end. Members’ savings increased by 16% (to £1,674,844). However, even though we issued over £500k in loans, loan applications fell below anticipated levels, mirroring the national trend.

By the time we held our AGM, membership had grown to 2,017 active members (that’s members who are actively saving)!

And it’s not just our active membership and loan books that are growing, just take a look at our new payroll partnerships!

Our “Save As You Earn” scheme is good for:

Our total income during 2020/2021 was £213,036 (+75%) and our expenditure was £133,745 (-32%), meaning we made a surplus of £79,291, a fantastic increase on last year’s finances. With our outlook of stability, growth and sustainability for the Credit Union we look forward to continuing our growth as a social enterprise.

Credit unions continue to grow across Scotland. With UK and Scottish Government support, this growth can be expected to continue.

I want to pay tribute to our dedicated staff and their willingness to adapt to changing circumstances. We really do benefit from having a team who has a positive, “can do” spirit!

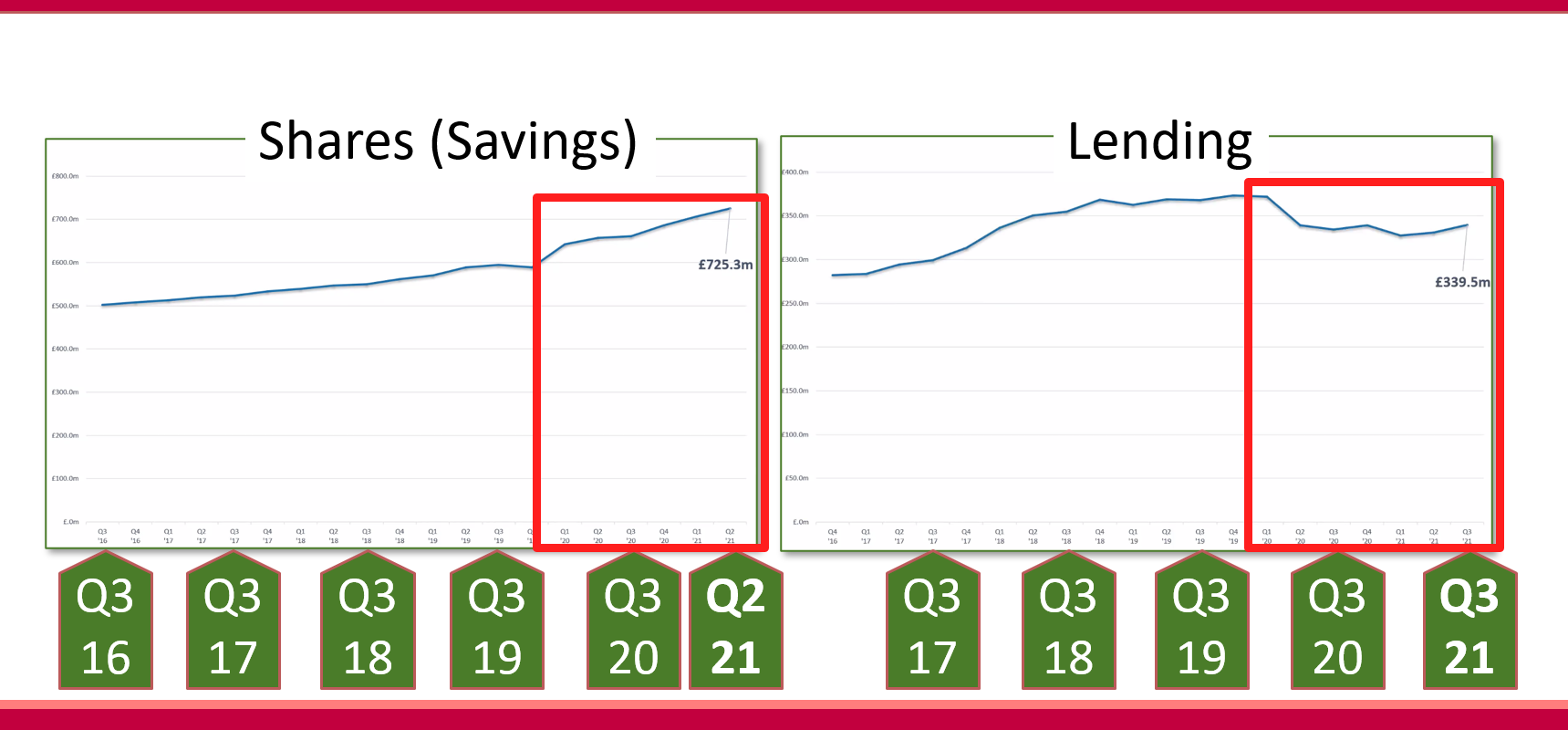

As for the pandemic, data recently published by the Bank of England (who monitor and regulate the UK’s credit unions) show that members saved more (see below on the left), but borrowed less (below on the right - the red boxes highlighting the period covered by the pandemic):

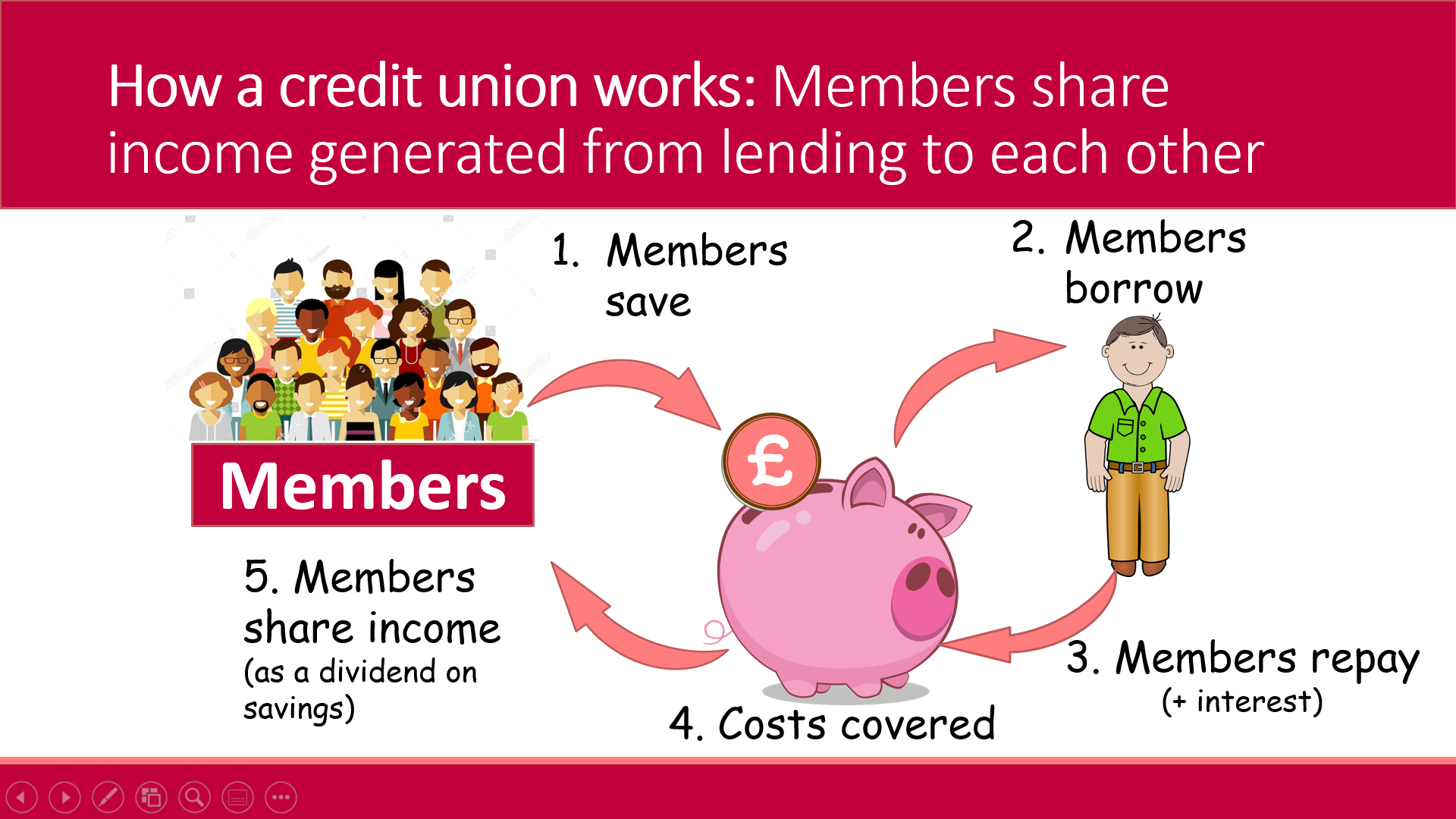

This isn’t good news for credit unions! This is because we rely on members borrowing to enable us to reward members who save with us:

We want more people to hear about us and become members. So this year we engaged the services of a marketing agency, Zync Digital, a marketing agency that specialises in the Credit Union sector. The results speak for themselves. We received our highest volume of loan applications ever, as well as a record increase in memberships.

During the year we said farewell to staff and volunteers:

Thank you for your on-going support of our credit union.

Remember, YOU can have a positive impact on the growth of our credit union:

Kind regards

![]()

Stephen Worgan

Chair

.png)

Scotwest Credit Union is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority (FRN 213616)

© 2024 Scotwest Credit Union